Fresh Investment Sees Minor Downturn of 4.8% in FY2024

In the fiscal year ending 31 March 2024 (FY2024), the total fresh investment remained closely aligned with the investment figures of the previous fiscal year (FY2023). Fiscal 2023 had seen an unprecedented surge in new investment proposals. The fiscal 2024 saw the announcement of 10,448 projects, valued at Rs 35,22,577.31 crore, a slight decrease from the 10,509 projects worth Rs 36,99,673.33 crore announced during FY2023. Despite experiencing a notable increase in fresh investments in the final quarter of FY2024, a significant drop of 41.72 percent in the third quarter of FY24 contributed to an overall annual reduction of 4.79 percent in fresh investments.

The last quarter of FY2024 was marked by the announcement of 3,130 new projects, collectively worth Rs 14,63,665.04 crore, which represented a substantial quarter-over-quarter growth of 235.47 percent, compared to the 1,996 new projects worth Rs 4,36,303.07 crore announced in the preceding quarter (Q3/FY24).

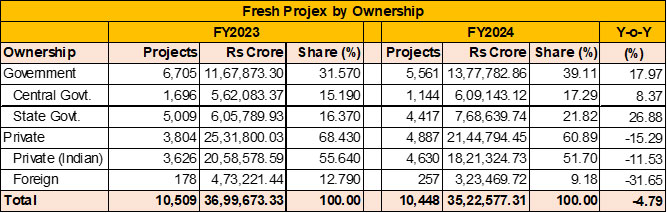

Projex by Ownership

The Government sector, though it could not repeat the stellar growth rate of 94.76 percent registered in FY2023, managed to post an increase of 17.97 percent in FY2024. Central government investment rose by a modest 8.37 percent in FY24, a decrease from the 103.92 percent increase of the previous year. Fresh investment by State government agencies saw a notable rise of 26.88 percent in FY24. This helped in lifting the share of the Government sector in the overall fresh investment to 39.11 percent as against 31.57 percent in FY2023. But for the state elections in some major states in the third quarter of FY2024, fresh investment flows from the State government sector would have been still higher.

Conversely, Private sector investments witnessed a decrease of 15.29 percent in FY2024 against a 90.71 percent growth recorded in FY2023. While Private (Indian) investments declined by 11.53 percent in FY2024, new investment commitments by foreign entities experienced a significant downturn of 31.65 percent. As a result, the collective share of the Private sector dropped to 60.89 percent from 68.43 percent in the preceding year.

In summary, the 15.29 percent decline in Private investment led to an overall decline of 4.79 percent in fresh investment in FY2024.

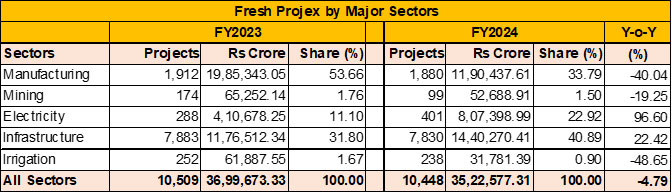

Projex by Sectors

Among the major sectors barring Infrastructure and Electricity others like Manufacturing, Mining, and Irrigation registered declines in fresh investment in FY2024.

The decline in the Manufacturing sector was prominent at 40.04 percent on a Y-o-Y basis. Both the number of projects and investments declined in FY2024. As against 1,912 new projects worth Rs 19,85,343.05 crore, FY2024 saw an announcement of 1,880 projects worth Rs 11,90,437.61 crore.

The decline in the number of super mega projects (Rs 25,000 crore or more) was one of the main reasons for the steep decline the sector suffered in FY2024. As against 28 super mega projects (in the Green Hydrogen and Semi-conductor sectors) worth Rs 14,38,311 crore in FY2023, the fiscal FY2024 saw the announcement of 14 such projects worth Rs 5,88,164 crore.

Further, reflecting the overall dip in Private investment, the Manufacturing sector's dominance in the total investment portfolio reduced from 53.66 percent in FY2023 to 33.79 percent in FY2024. The sectors which attracted sizeable fresh investments in FY2024 were Cement, Steel, Machinery and Automobiles. While the Green Hydrogen and Semi-conductors sectors did attract new project proposals, they could not match the quantity of investment proposed in the preceding fiscal.

In the Cement sector, 79 new projects with a total investment outlay of Rs 52,860.87 crore intend to add new production capacities of around 135 mln. tpa. The sixty-odd primary and integrated steel projects intend to install an additional 30 mln. tpa steel capacities, supported by captive power plants, at a cost of Rs 2,30,000 crore.

Though during FY2024 the country saw announcements of new Semiconductors and Green Hydrogen projects, the total investment promised therein could not match the quantum of investment proposed in FY2023. The semiconductor sector could attract only Rs 1,47,527 crore of new investment as against Rs 3,32,000 crore capex committed in FY2023. Similarly, as against 42 Green Hydrogen & Ammonia projects worth Rs 9,50,000 crore proposed in FY2023, only 20 projects worth Rs 1,42,000 crore were announced in FY2024.

Led by the Rs 35,000 crore Passenger car project of Maruti Suzuki in Gujarat, the Automobiles sector posted a year-on-year growth of 60.31 percent in fresh investment. As against 122 projects worth Rs 92,279.73 crore announced in FY2023, 126 new projects worth Rs 1,47,935.93 crore were announced in FY2024.

Some of the prominent projects announced in this sector include a Rs 16,000 crore Electric Vehicles project of VinFast Auto in Tamil Nadu and a Rs 12,842 crore EV project of Gogoro India in Maharashtra. The passenger car majors, Skoda Auto and Tata Motors are investing Rs 9,000 crore each for setting up passenger car units in Maharashtra and Tamil Nadu respectively. In the Auto Ancillaries sector, the Rs 11,750 crore Aerospace Components project of Kalyani Steels in Odisha was the largest one.

In FY24, the Electricity sector benefitted from the announcement of the increased number of Pumped Hydel power projects. The sector, which registered a year-on-year growth of 174.90 percent in FY2023, saw fresh investments surging by 96.60 percent in FY2024. Following this, the sector’s share increased from 11.10 percent to 22.92 percent. The year saw announcements of 99 Pumped Hydel power projects worth Rs 4,79,848.84 crore with a total generation capacity of around one lakh MWs. Similarly, the 218 new Solar power projects worth Rs 1,82,120 crore intend to add around 51,000 MW of clean energy capacity. Additionally, the year also saw the announcement of 16 thermal power projects with an intention to add around 12,000 MW of generation capacity.

The Infrastructure sector, with an annual growth of 22.42 percent accounted for 40.89 percent of the total fresh investment announced in FY2024. In all, 7,830 new proposals with an investment commitment of Rs 14,40,270.41 crore were made in FY2024. The preceding year had seen announcements of 7,883 projects worth Rs 11,76,512.34 crore. Within this sector, the Roadways, Railways, Construction and Water Supply and Treatment sectors attracted the bulk of the fresh investment.

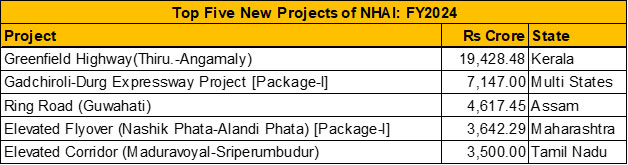

In FY2024, 1,773 new Roadways/Highways projects entailing a total investment of Rs 4,48,303.10 crore were announced. Among the project promoters NHAI, the national highways builder, accounted for 28.7 percent of the total fresh investment announced in this sector. In all, NHAI announced 150 new projects worth Rs 1,28,616 crore. MSRDC of Maharashtra was another prominent player with 45 new projects worth Rs 69,734 crore of new investment.

Some of the NHAI projects are listed below.

A couple of Metro Rail projects increased the total fresh outlays in the Railways sector to Rs 1,16,277.62 crore in FY2024. Prominent among these projects were the three phases of the Hyderabad Metro Rail projects with total outlays of Rs 60,000 crore. Tricity and Faridabad-Palwal metro projects were the other mega projects announced during FY2024.

The construction sector (comprising Commercial Complexes, Real Estate, and Industrial Parks) saw the total fresh outlay increase by 53.47 percent on a Y-o-Y basis. The three sectors together witnessed the announcement of 2,824 new projects worth Rs 4,75,870.67 crore. The Real Estate sector, which has witnessed a revival in investment in the last couple of years, saw announcements of 2,142 new projects worth Rs 3,24,117.67 crore in FY2024 as against Rs 2,12,961.90 crore announced in FY2023.

In FY2024, Mining and Irrigation's shares decreased to 1.50 percent and 0.90 percent, respectively. Mining also saw the expansion of decrease in fresh investment from -4.17 percent in FY2023 to -19.25 percent in FY2024. The irrigation sector posted a massive growth of 368.05 percent in FY2023 but faced a sharp decline of 48.65 percent in FY2024.

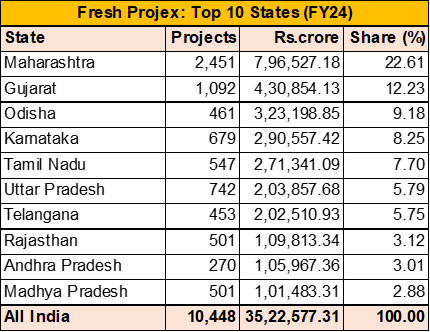

Projex by States

Among the major states, Maharashtra emerged as the top state in FY2024, climbing from the fourth rank in FY2023, with an increase in investment from Rs 3,71,194.80 crore to Rs 7,96,527.18 crore. The state attracted 22.61 percent of the total fresh investment. A Rs 63,426 crore Versova-Virar- Palghar Sea Link Project of Mumbai Metropolitan Region Devp. Authority, a Rs 40,000 crore Steel Plant of ArcelorMittal Nippon Steel India, a Rs 27,000 crore Saidongar & Junnar Pumped Storage Hydel Power Project of Torrent Power, and a Rs 25,000 crore Green Ammonia Project of Inox Air Products are some of the mega projects the state attracted during FY2024. Additionally, Tata Power and NHPC are investing heavily in Hydel Power Projects in the state.

Gujarat retained its second position by attracting 12.23 percent of the total fresh investment announced in FY2024. In all, the state saw announcements of 2,451 projects worth Rs 4,30,854.13 crore. A Rs 91,000 crore Semiconductor Fabrication project of Tata Electronics at Dholera, a Rs 35,000 crore Passengers Cars project of Maruti Suzuki India and a Rs 17,500 crore Metallurgical Grade Silicon & Polysilicon at Jamnagar of Reliance New Energy Solar are some of the mega projects lined up in the state.

Odisha bettered its ranking from fifth to third, with a total new capex of Rs 3,23,198.85 crore. Steel and Solar projects helped the state in improving its rank. Some of the mega projects attracted by the state are a Rs 75,000 crore Steel Plant (Jatadhar) Expansion of JSW Utkal Steel, a Rs 36,000 crore Solar Panels (Khurda) Project of ACME Greentech Urja, and a Rs 21,000 crore Steel Plant (Jharsuguda) Expansion of Action Ispat & Power.

Of the two southern states, while Karnataka slipped from third to fourth rank due to the fall in fresh investment from Rs 4,32,703.72 crore in FY2023 to Rs 2,90,557.42 crore in FY2024, Tamil Nadu bettered its rank from eighth in FY2023 to fifth in FY2024 due to the surge in fresh investments from Rs 1,73,494.34 crore to Rs 2,71,341.09 crore.

Outlook: FY2025

Projects Today believes that the rate of new investment announcements might slow down in the first quarter of FY2025 due to the extended general election period. However, post-June 2024, with the new government assuming office, the flow of fresh investment is expected to gain traction.

To keep the capex cycle on the move the new central government, we believe would not only continue the prevailing investor-friendly policies but would bring in further reforms.

Against the backdrop of the announcement of Rs 72.22 lakh crores of fresh investment in the last two fiscals, the new government must ensure the timely execution of these projects by closely monitoring their progress. Delays in implementation of these projects, especially those, which were announced in the critical sectors like Green Hydrogen, Semi-conductors, Electric Vehicles, Transport Infrastructure, Hydel and Solar Power could impede the growth trajectory of the Indian economy in the coming years.

About Projects Today

Projects Today is India's largest online databank on new and ongoing projects in India. The website, launched on 8 September 2000, aims to provide the required foresight to its clients based on sectoral insights its research team possesses. The project-related information provides an invaluable marketing resource to assist the business development efforts of the organisations that focus on the new projects market. It is widely used by the project fraternity, primarily, as a business opportunity identifier.

Projects Today conducts Survey of Project Investment, at the end of every financial quarter to gauge the trends in projects investment in India by sectors, state, ownership, etc.

Disclaimer : The opinions expressed within this interview are the personal opinions of the interviewee. The facts and opinions appearing in the answers do not reflect the views of Indiastat or the interviewer. Indiastat does not hold any responsibility or liability for the same.

Fresh Investment Grew by 9.9% in Q3/FY25... Read more